The spreadsheet has been crafted with the goal of providing ease of use and simple navigation, making it an indispensable tool for any small business.

Simple GST Spreadsheet

Major software companies often offer overly complex accounting systems that come with a hefty price tag, which can be prohibitive for many small businesses. However, there is now an alternative to these expensive systems – a cost-effective and straightforward solution.

At only $25.00 (inclusive of GST), our GST Spreadsheet has proven to be a popular choice among small businesses, with over 350 downloads to date. The spreadsheet is designed specifically to meet the needs of small businesses, offering a simple and intuitive way to keep track of GST collected and paid each quarter, as well as manage income and expenses for end-of-year tax returns.

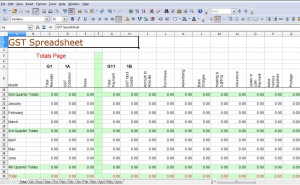

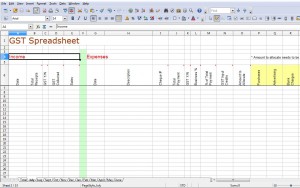

Please refer to the below screenshots for a visual representation of the spreadsheet’s income and expenses tracking, as well as a totals page showcasing the quarterly and annual balances.

Income

Our spreadsheet has been designed with simplicity and ease of use in mind. It features 12 monthly tabs, along with a comprehensive totals page, to ensure that all relevant information is organized and accessible. The spreadsheet’s automated functionality allows for seamless updates to the totals page as information is entered on a monthly basis.

To input income, simply enter the transaction date, the total amount received, and whether the transaction is subject to GST. For businesses that are registered for GST, it is typically the case that all income is subject to tax. The GST and sales columns are calculated automatically by the spreadsheet’s advanced formulaic capabilities.

Expenses

To record expenses, the date and description of the transaction must be specified, as well as the total amount of payment. For example, if an expense of $55.00 was incurred for fuel for a car on March 14, 2011, the date and description would be entered as such. The business percentage of the transaction should also be indicated. If the vehicle is solely used for business purposes, the business percentage would be 100%. However, if the vehicle is used for both personal and business purposes, the applicable percentage should be entered.

The spreadsheet automatically calculates the GST and the amount to allocate, which should then be allocated to one of the expenses in the designated, yellow-highlighted columns. To ensure accuracy, the spreadsheet includes a checksum that compares the total of the “amount to allocate” with the total of the “yellow highlighted columns.” If the figures match, the checksum will display a “Y,” indicating that the entries are correct. If the figures do not match, the checksum will display an “N,” and the amounts entered in the “yellow highlighted columns” should be reviewed for accuracy.

Upon completion of entering data for a quarter, proceed to the totals page and transfer the relevant quarterly totals to the Business Activity Statement.

In the event that modifications to the expense column description or page title are necessary, simply edit the description on the totals page, and the changes will be reflected throughout the month.

Instruction Video

Payments

Payment options for the GST Spreadsheet include PayPal, credit card, and direct deposit. To make a payment through PayPal, please click the “Buy Now” button and follow the prompts.

For credit card or direct deposit payment, please send an email for further instructions and to arrange for receipt of the spreadsheet after payment has been processed.

Tips

- Please exercise caution when copying and pasting to ensure that you do not inadvertently copy and paste locked calculation fields, as this may result in “#REF” errors.

- It is recommended to maintain a backup copy of a blank sheet for future financial years.

*It is advisable to take note that the spreadsheet has been secured to prevent unintended modification to its inbuilt formulas. Requests for unlocking the code will not be entertained.