Client to Agent Linking Set Up – New Australian Tax Office initiative.

Starting 13th November 2023 the Australian Taxation Office (ATO) has broadened the scope of the Client to Agent linking in Online Services to include the following entities with an ABN;

- companies including strata title bodies

- partnerships

- trusts

- not-for-profits

- joint ventures

- cooperatives

- self-managed super funds (SMSFs)

- APRA-regulated superannuation funds.

What is Client-to-Agent Linking

When you decide to engage the services of a Registered Tax Agent, Registered BAS Agent, or Payroll Services Provider, it is important to establish a secure connection between you and your agent. This process is known as client-to-agent linking. Here’s how it works:

- Adding the Tax Agent’s Number to your online services account: As a client, you will need to add the Tax Agent’s Number to your online services account. This step ensures that you have authorised the specific agent to access your records and handle your tax matters.

- Agent adding you to their client list: Once you have added the Tax Agent’s Number to your account, the agent will then add you to their client list. This step completes the client-to-agent linking process and establishes a secure connection between you and your agent.

By implementing client-to-agent linking, an additional layer of security is added to protect your sensitive information. You can have peace of mind knowing that only the registered agent associated with the authorised agent number will be able to view and manage your records. This helps safeguard your privacy and ensures that your tax affairs are handled by a trusted professional.

Reducing Fraudulent Behaviour and Identity Theft

Identity theft and fraud are serious concerns that can affect both taxpayers and registered agents. In today’s digital age, criminals have found new ways to exploit unsuspecting individuals. Here are a couple of scenarios where criminals may pose as someone else:

- Taxpayers may unknowingly engage an agent to assist them in committing fraud. For instance, these criminals might convince an agent to submit fraudulent lodgments on their behalf, resulting in undeserved refunds.

- Another tactic involves criminals posing as agents to gain unauthorized access to client information and exploit the services available on our digital platforms, such as Online services for agents.

It’s crucial to stay vigilant and take necessary precautions to protect yourself from such fraudulent activities. By being aware of these risks and staying alert while conducting online transactions, you can significantly reduce the chances of falling victim to identity theft and fraud.

Steps to setting up the Client-to-Agent Link

I have linked to a video below created by The Field Group Accounting in 2021, the information should still be relevant today.

3 steps need to be completed to set up the ATO online services for your business, once you have Online services set up you can link your business to the agent.

You may have already completed the next 3 steps, please ignore and continue to the next step if you have.

Step 1 – Setting up MyGovID on your Apple or Android Device

** Note MyGovID is an app that needs to be downloaded onto a smart device and is not MyGov **

To set up the MyGovID app, you can follow these steps:

- Download the MyGovID app: Visit the app store on your smart device and search for “MyGovID.” download and install the app on your device.

- Open the app: Once the app is installed, open it on your smart device.

- Enter your details: In the app, you will be prompted to enter your full name, date of birth, and personal email address. Make sure to provide accurate information.

- Choose your authentication method: The MyGovID app offers different authentication methods, such as using your fingerprint or a PIN. Select the method that suits you best and follow the prompts to set it up.

- Verify your identity: Depending on your chosen authentication method, you may need to verify your identity. This could involve scanning your face or providing additional information.

- Set up your MyGovID: Once your identity is verified, you will be guided through the process of setting up your MyGovID. This may include creating a password or setting up additional security measures.

- Link your MyGovID to services: After setting up your MyGovID, you can link it to various government services and platforms. This will allow you to access and manage your information securely.

It’s important to note that the specific steps may vary slightly depending on the device you are using and any updates to the MyGovID app. It’s always a good idea to refer to the official documentation or support resources provided by the MyGovID app for the most accurate and up-to-date instructions.

Step 2: Link your myGovID to your ABN

To link your myGovID to your ABN, you can follow these steps:

- Set up your myGovID: If you haven’t already, you need to set up your myGovID. Visit the myGovID website or download the myGovID app from your device’s app store. Follow the instructions to create your myGovID using your personal details.

- Link your ABN in RAM: Once you have your myGovID, you need to link your ABN (Australian Business Number) in the Relationship Authorisation Manager (RAM). RAM is a secure online service that allows you to manage authorisations for your business. Visit the RAM website and log in using your myGovID.

- Access the ABN registration: In RAM, you will find the option to access the ABN registration. Click on it to proceed.

- Link your myGovID to your ABN: In the ABN registration section, you will see the option to link your myGovID to your ABN. Follow the prompts and provide the necessary information to complete the linking process.

- Verify your identity: As part of the process, you may be required to verify your identity. This could involve providing additional information or completing identity verification steps.

- Confirm the linking: Once you have provided all the required information and completed the necessary steps, you will receive a confirmation that your myGovID has been successfully linked to your ABN.

By following these steps, you will be able to link your myGovID to your ABN, allowing you to access government online services on behalf of your business securely.

Step 3: Log in to Online Services for Business

Use your myGovID to log in to Online Services for Business.

Step 4: Nominate your authorised agent in Online services for business

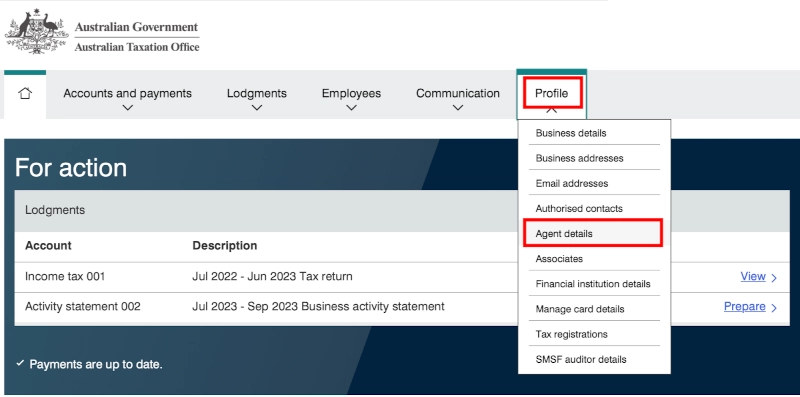

From the Online Services for Business home page:

- select Profile, then Agent details

- at the Agent nominations feature, select Add

- on the Nominate agent screen, go to Search for agent

- type your agent’s (or payroll service provider’s) registered agent number and select Search

- select the agent you want to nominate

- check that the agent’s details are correct

- complete the Declaration

- select Submit.

You’ll now see your agent’s details listed under Agent Nominations.

Step 5: Let your agent know you have nominated them

The agent you nominate won’t receive an automated system notification. It’s important to let them know when you’ve completed the nomination step.

Your agent has 28 days to action the nomination before it expires.

Extending a nomination

If the agent you’ve nominated needs more time to add you as a client, you can use the extend feature. This will add another 28 days to your nomination from the day you extend.

The Extend feature will become available the day after submitting a nomination. It will remain available to select anytime during the 28 calendar days of the original nomination period.

To extend a nomination:

- from the Agent nomination screen in Online Services for Business, select Extend. Tip: You can find this next to your agent’s name.

- at the Extend agent nomination screen, check the details of the agent are correct. If they are not correct, you can delete an agent nomination by selecting Delete.

- complete the declaration and select Submit

- let your agent know when you have completed the extension.

- If a nomination has expired, you won’t be able to extend it. You’ll need to submit a new nomination.

Conclusion:

Client-to-Agent Linking is an important initiative introduced by the Australian Taxation Office (ATO) to enhance security and streamline tax-related services for non-individual entities with an ABN. By establishing a secure connection between clients and their registered tax agents, the ATO aims to safeguard sensitive information and protect against fraudulent behaviour and identity theft.

Starting from 13th November 2023, the scope of Client to Agent linking in Online Services has been expanded to include various entities with an ABN, such as companies, partnerships, trusts, not-for-profits, and more. This broadening of the initiative ensures that a wider range of organizations can benefit from the secure connection between clients and their tax agents.

To set up the Client-to-Agent Link, there are three essential steps to follow:

- Add the Tax Agent’s Number to your online services account: As a client, you need to add the Tax Agent’s Number to your online services account. This step authorizes the specific agent to access your records and handle your tax matters.

- Agent adding you to their client list: Once you have added the Tax Agent’s Number, the agent will then add you to their client list. This completes the client-to-agent linking process, establishing a secure connection between you and your agent.

By implementing Client-to-Agent Linking, an additional layer of security is added to protect your sensitive information. This ensures that only the authorized agent associated with the agent number will be able to view and manage your records, reducing the risk of unauthorized access.

To further combat fraudulent behaviour and identity theft, it is important to remain vigilant and take necessary precautions. Stay aware of potential risks and be cautious while conducting online transactions. By being proactive, you can significantly reduce the chances of falling victim to identity theft and fraud.

If you have any further questions or require assistance with setting up the Client-to-Agent Link, you can contact the ATO directly at their helpline: 13 28 66. Their dedicated support team is available to provide guidance and address any concerns you may have.

Take advantage of the Client-to-Agent Linking initiative to ensure a secure and efficient tax filing process. By working closely with your registered tax agent, you can navigate the complexities of taxation with confidence and peace of mind.

Remember to stay informed about the latest ATO guidelines and regulations to make the most out of this initiative and fulfil your tax obligations effectively. Embrace the Client-to-Agent Linking process and experience a seamless and secure tax journey.