The spreadsheet has been crafted to provide ease of use and simple navigation, making it an indispensable tool for any small business.

Simple GST Spreadsheet

Major software companies often offer overly complex accounting systems with a hefty price tag, which can be prohibitive for many small businesses. However, there is now an alternative to these expensive systems – a cost-effective and straightforward solution.

At only $25.00 (inclusive of GST), our GST Spreadsheet has proven to be a popular choice among small businesses, with over 350 downloads to date. The spreadsheet is designed specifically to meet the needs of small businesses, offering a simple and intuitive way to keep track of GST collected and paid each quarter, as well as manage income and expenses for end-of-year tax returns.

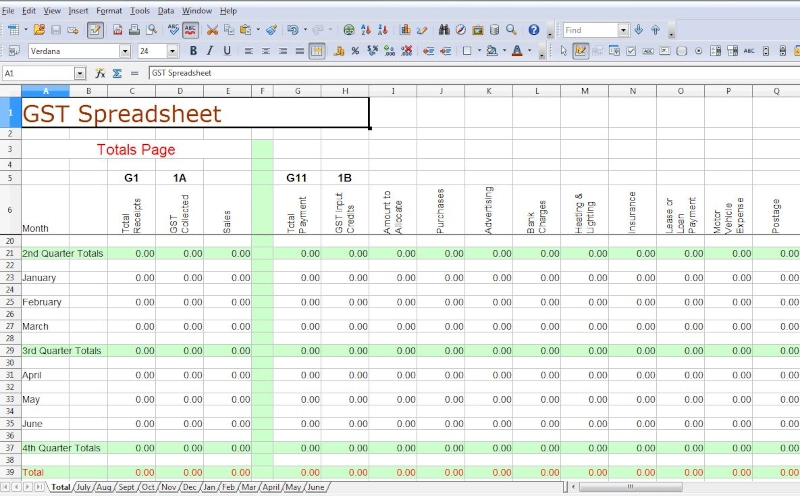

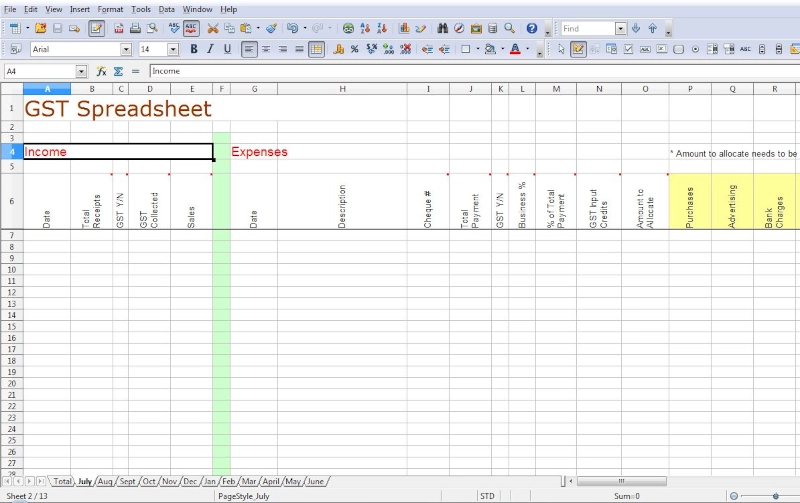

Please refer to the screenshots below for a visual representation of the spreadsheet’s income and expenses tracking and a totals page showcasing the quarterly and annual balances.

Income

Our spreadsheet has been designed with simplicity and ease of use in mind. It features 12 monthly tabs, along with a comprehensive totals page, to ensure that all relevant information is organized and accessible. The spreadsheet’s automated functionality allows for seamless updates to the totals page as data is entered every month.

To input income, simply enter the transaction date, the total amount received, and whether the transaction is subject to GST. For businesses that are registered for GST, it is typically the case that all income is subject to tax. The GST and sales columns are calculated automatically by the spreadsheet’s advanced formulaic capabilities.

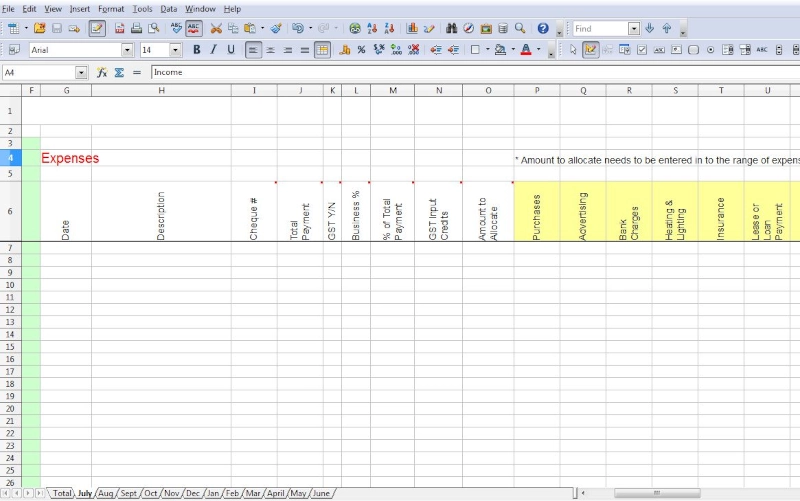

Expenses

To record expenses, the date and description of the transaction must be specified, as well as the total amount of payment. For example, if an expense of $55.00 was incurred for fuel for a car on March 14, 2011, the date and description would be entered as such. The business percentage of the transaction should also be indicated. If the vehicle is solely used for business purposes, the business percentage would be 100%. However, if the vehicle is used for both personal and business purposes, the applicable percentage should be entered.

The spreadsheet automatically calculates the GST and the amount to allocate, which should then be allocated to one of the expenses in the designated, yellow-highlighted columns. To ensure accuracy, the spreadsheet includes a checksum that compares the total of the “amount to allocate” with the total of the “yellow highlighted columns.” If the figures match, the checksum will display a “Y,” indicating that the entries are correct. If the figures do not match, the checksum will display an “N,” and the amounts entered in the “yellow highlighted columns” should be reviewed for accuracy.

Upon completion of entering data for a quarter, proceed to the totals page and transfer the relevant quarterly totals to the Business Activity Statement.

In the event that modifications to the expense column description or page title are necessary, simply edit the description on the totals page, and the changes will be reflected throughout the month.

Instruction Video

Payments

Payment options for the GST Spreadsheet include PayPal, credit card, and direct deposit. To make a payment through PayPal, please click the “Buy Now” button and follow the prompts.

For credit card or direct deposit payment, please send an email for further instructions and to arrange for receipt of the spreadsheet after payment has been processed.

Tips

- Please exercise caution when copying and pasting to ensure that you do not inadvertently copy and paste locked calculation fields, as this may result in “#REF” errors.

- It is recommended to maintain a backup copy of a blank sheet for future financial years.

*It is advisable to take note that the spreadsheet has been secured to prevent unintended modification to its inbuilt formulas. Requests for unlocking the code will not be entertained.

Hi, Its a great spreadsheet thanks. I don’t need half the expense columns. Can the unnecessary ones be deleted?

Thanks, Barry deleting the unwanted columns would create errors with the formulas in the spreadsheet.

hi

Could you please tell me how to delete #REF! from cells E, G-J. I tried to cut and paste cells C 30 -37 to cells C7-14. But then #REF! came up in those cells and i cant delete them.

Thanka

The short answer is not to copy & paste locked cells, the cells will need to unlocked and the formulas re-entered

Really love the spreadsheet, purchased for our BAS prep. Any way I could filter the spreadsheet to be in date order. I enter purchases as they come in so not all reflect straight away. I understand why certain cells are locked but this would be very handy.

Hi – if I have missed a couple of entries and need to insert them before an entry that has already been lodged (put in date order), how can I move the row down to put the missing entry in?

Kerry, before you make any changes save a separate copy of the work that you have already done.

You can cut and paste all the fields except the locked ones, the locked fields should recalculate after you have copied and pasted. I haven’t tried this my self. Columns E, F, N and AI are locked. Cut and paste columns A to D and move down the required amount of rows, G to M and then O to AH.

I hope you understand what I am trying to suggest, as I mentioned before make a back up should it all go wrong.

Thanks

Geoff

I am in Canada and we also have GST, at what rate is the GST in this spreadsheet and can it be modified as and when/if the rate changes?

Phil, the GST rate in Australia is 10% and typically paid quarterly. I can make the changes to the rates to match Canada’s rates assuming they are not the same as Australia.

Hello,

I’ve just purchased your 16 expense worksheet however as a psychologist in private practice doesn’t include as many expense items as required – does your 30 expense items includes things such as conferences, professional books/subscriptions etc.?

Michelle, if you go to the headings on the totals page you can change the expense items to what you want, and the changed items will show on the monthly tabs.

https://youtu.be/XaCNrdnDXlk

So cool

Hi. I have recurrent expenses that I would like to cut-and-paste into each month, but I get a message saying the sheet is password protected.

As soon as you try and past over the locked column of “% of total payment” it will display the “sheet is password protected” message. I have locked that column so the calculations of the spreadsheet aren’t compromised.

All I can suggest that you do is to copy the information before the that field and paste and then cut and paste the information in the yellow highlighted columns.

That works, thanks.

Hi – I have been using this spreadsheet for approx. the last 8 months and find it very simple to use… it has suited my needs perfectly.

Recently the ATO made changes to my BAS/Personal Income Tax and I am now required to pay Income Tax in installments.

I was just wondering if the spreadsheet can be update to calculate this information automatically?

Simon, the ATO will either give you 2 options to the amounts to be paid on a quarterly basis, either a set amount or a percent of your income after GST.

Both options are relatively easy to calculate at the time of preparing the BAS and the percentage and set amount are displayed on the BAS form.

I am quite happy to discuss further and make some additions to the spreadsheet, email me at geoff@accountantplus.com.au with details of the addition you would like to see.

Regards

Geoff

Thank you for your great feedback.

Hi Geoff

Can this app also record inventory and produce invoices ??

Richard,

No, it’s a simple spreadsheet for income and expenses.

Geoff

Hello, I have just purchased your spreadsheet. I began entering data in the Income column. The first date entered okay, from then on the date entered as a random number, like 42202, even though I entered 17/07/2015. Also, can I add a column for “description” under Income? Further, how do I customise my expenses categories? Thanks.

Hi David, you can the date by doing the following, Select the cells you want to format, Press CTRL+1, In the Format Cells box, click the Number tab, In the Category list, click Date and choose the format that you want.

To change the catagories for the expenses, go to the totals page and change to column headings there, the new heading will be reflected through the the monthly tabs. Put the most popular expenses in the first columns

Unfortunatley at the moment there is no provision for description in the sales column, it mat be a field that I will add.

Hi I have been using erecord for many years but comp crashed and all is lost. I am now using a new Mac comp and was wondering if I can use your GST spreadsheet program to replace erecord. The only question I need to know is I have a business offset account that I move funds out of or into my company account. It is under the company name as well but that account pays interest so when my company account has more than the needed operating capital it is transferred out. If short in company account or for has payments etc it is transferred back. Does your GST spread sheet have the ability to split that input and not recognise it as income. I don’t want to be paying tax on the same income twice. If it can I will purchase your program.

The spreadsheet is simple and any splitting of income and expenses will need to be done mannually. Also if a deposit isn’t income then do not enter on the spreadsheet.

Thank you for that feedback, the issue has been fixed