Demutualisation of Insurance Companies

I have compiled a list of companies that demutualized more than 20 years ago, during the last century. It’s hard to believe, but I feel old typing this because I received an allotment of AMP shares at that time. Since I first added this information to my website in 2008, a lot has changed, and it definitely needs an update.

Since 2008, there have been demergers, takeovers, and capital returns that have diluted the original issue price of the share. All calculations in this post will assume that you received 1000 shares at the time of demutualisation and sold the appropriate number of shares as of February 2023.

Scrip for Scrip Rollover

If your shares are part of a merger, a capital gain event occurs. However, if you choose a scrip for scrip rollover, that event is postponed until you sell the new shares. If you do a partial rollover or don’t do a rollover, a capital gain calculation would have taken place at the time of the merger. For all subsequent calculations, I will assume that a full scrip for scrip option was chosen.

Dividend Reinvestment Plan (DRP)

A dividend reinvestment plan (DRP) is a program offered by some companies that allow shareholders to automatically reinvest some or all of their dividends into additional shares in the company, rather than receiving cash payments. For all subsequent calculations, I will assume that a DRP was not in place.

What is Demutualisation?

Demutualisation is the process by which a mutual organisation, such as a mutual insurance company or a mutual savings bank, converts itself into a publicly traded company. This typically involves issuing shares to the members of the mutual organisation and listing them on a stock exchange. Demutualisation can provide the organisation with greater access to capital and may also result in increased transparency and accountability. However, it may also result in a loss of control by members and a shift in focus towards shareholder value rather than member service.

Market Values

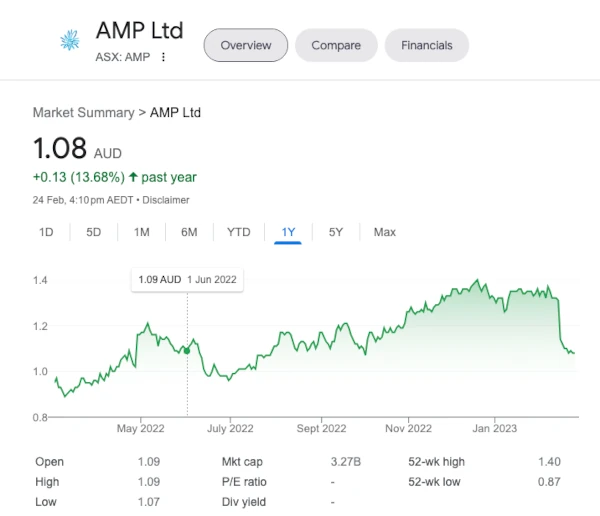

As of February 25th, 2023, the market value for AMP is $1.08, for IAG it is $4.77, and for CBA it is $101.22. All calculations will exclude any broker fees for selling shares.

National Mutual/AXA

When National Mutual demutualised, the cost base of their shares was $1.14 on October 3rd, 1996. When AMP and AXA merged on March 30th, 2011, the market value of the new AMP share was $5.32. The capital proceeds for each AXA share are $3.8836 (0.73 multiplied by $5.32, the market value of an AMP share on March 30th, 2011) plus $2.5464 cash. Please refer to the ATO fact sheet [1] for more information.

Example: At the time of demutualisation, you received 1000 shares at $1.14. In March 2011, those shares became 730 AMP shares valued at $3883. If sold today, the value of the shares would be 730 shares at $1.08, totalling $788. The sale price of $788 less the cost base of $3883 would result in a capital loss of $3094. This loss can only be used to offset capital gains in the current year and, if no gains in the current year, future gains.

AMP

The shares that were issued during AMP’s demutualisation on January 1, 1998, had an original cost base of $10.43. However, in 2003, AMP demerged into two separate companies, with the second one being Hendersons. Additionally, in the years 2005, 2006, and 2007, AMP issued capital returns of 40 cents each year. As a result of both the demerger and the capital returns, the cost base of the shares is now $6.19. [2]

Example: At the time of demutualisation, you received 1000 shares, and the cost base had been reduced to $1.585 from $1.78, as mentioned above. If sold today, the value of the shares would be 1000 shares at $1.585, totalling $1585. The sale price of $4770 less the cost base of $1585 would result in a capital gain of $3185. As the shares have been held for over 12 months, a discount of 50% is applied to the gain. The taxable component of the gain would be $1592.50, which can be offset against any capital losses or included in your assessable income.

Colonial Mutual

On May 19, 1997, Colonial Mutual demutualised, and the cost base of the shares was $3.31. In 2000, Colonial became a part of the Commonwealth Bank Group, and for every 20 Colonial Mutual shares owned, 7 CBA shares were issued.

Example: Suppose you received 1000 shares at the time of demutualisation. In that case, the cost base of the shares would be $3310. When CBA took over the shares, you received 7 shares for every 20 Colonial Mutual shares owned, resulting in 350 CBA shares. If you sold these shares today, the value of the Colonial Mutual shares would be $3.31 per share, totalling $3310. The value of the CBA shares would be 350 shares at $101.22, equaling $35,427. The capital gain would be $32,117, calculated as the sale price ($35,427) minus the cost base ($3310). As the shares have been held for over 12 months, a discount of 50% is applied to the gain, resulting in a taxable component of the gain of $16,085.

NRMA

On August 8th, 2000, NRMA underwent demutualisation and became the NRMA Insurance Group Limited. The shares allocated at the time had an original cost base of $1.78. Two years later, in 2002, NRMA Insurance Group Limited changed its name to Insurance Australia Group Limited (IAG).

Then, on October 26th, 2018, IAG shareholders approved a capital management initiative, resulting in a return of capital of 19.5 cents. This move reduced the original cost base from $1.78 to $1.585.

Example: Suppose you received 1000 shares at the time of demutualisation, and the cost base had been reduced to $1.585 from $1.78, as mentioned above. If you were to sell the shares today, the value would be 1000 shares at $1.585, totalling $1585. If the sale price were $4770, subtracting the cost base of $1585 would result in a capital gain of $3185. Since the shares have been held for over 12 months, a discount of 50% is applied to the gain, making the taxable component of the gain $1592.

Disclaimer

Overall, it’s important to note that this information is for general guidance only, and you should seek professional advice before making any investment or tax-related decisions. Additionally, the calculations provided here assume certain conditions and are based on market values at a specific point in time. Therefore, it’s important to update your calculations regularly based on current market values and any changes in the company’s structure or policies.

Appendix

[1] https://www.ato.gov.au/Individuals/Ind/Events-affecting-shareholders/Merger-of-AMP-Limited-(AMP)-and-AXA-Asia-Pacific-Holdings-(AXA)-fact-sheet/?page=1 [2] https://corporate.amp.com.au/shareholder-centre/shareholder-info/tax-information#:~:text=Shares%20issued%20at%20AMP's%20demutualisation,2005%2C%202006%2C%202007) [3] https://www.iag.com.au/sites/default/files/Images/Shareholder%20centre/DOC_ATO_Tax_Information_March_2001_200103.pdf [4] Page 65 of the 2000 Annual Report: http://www.commbank.com.au/about-us/shareholders/pdfs/annual-reports/2000_Annual_report_financial_statements_1MB.pdf

I hope this site is still active. I have read the details in regards to Colonial shares to CBA shares and the values. I received 170 CBA shares with effect 13 Jun 00. It is great to have that detail, however, I need further detail in regards to the original allocation of the Colonial shares. Where can I get this info, i.e. the date, the amount and the value of the Colonial shares I was issued.

I have sold all my CBA shares and need to find the detail for my accountant for the 19/20 tax year.

Regards Glenn

Glenn

Did you get the 170 CBA because you owned Colonial Mutual Shares?

Did you buy the Colonial Mutual shares through a broker or received them because you were a policyholder when they demutualised?

If you were a policyholder of a Colonial Mutual product the cost base per share was $3.31. CBA offered you 7 shares for every 20 Colonial Mutual shares that you held on the 13th June 2000. The calculation for the cost base is 170 / 7 * 20 = 486 shares * $3.31 = $1608.66.

If you had bought the shares through a broker, then the purchase price of the shares is the cost base.

Regards

Geoff

Thanks for your CG answer. Other issue… Only DRP shares involved .. So tax is gain/ loss on the re- invested share amount for that year… Each miniscule change tajen into account as reorted 1 quarterly by NRMA, or, an aggregate from the beginning and end of tax year?

Thanks for clear information. Does capital gain calculation on dividend re- investment nrma shares, upon sale, have to be annual gain or loss, on each new package of re- invested shares, or is it a gain or loss at point of sale from initial grant. Wikipedia ? ato site says DRP shares are CG wise treated dufferently to shares purchsed.

Does your newsletter hace a price.. Or free? Rgds Patricia

Patricia

Dividend re-investments (DRP) are treated as a share purchase, so the cost price of those shares need to be taken into account when you sell the shares.

Say, you sold 1100 shares and 1000 shares were from the original purchase and then you received 10 DRPs of 10 shares you will need to find out the price of all 1100 shares.

It will be the sale price of 1100 shares less the purchase prices of 1100 shares, the balance being the capital gain or loss.

The newsletter is free.

We were gifted shares from Colonial mutual.

It was ages ago, possibly pre 1985

Now wish to sell but cannot find details.

Do you know where I could get details of these gifted shares

Can you ask the person who gifted you the shares? That would be the first place I would start.

It was Colonial Mutual, which no longer exists.

Tried that

Ok, I assume that the shares were given to you through the demutalisation of Colonial Mutual and now you own CBA shares, in that case the original Colonial Mutual shares had a value of $3.31.

For every 7 shares you had with CBA on the 14th June 2000 you would have had 20 Colonial Mutual shares. How many shares did you have in CBA in 2000, is it the same balance that you have now?

When did CMLA demutualise? After acquisition by a privatised CBA?

My understanding of demutualisation is that customers, policy holders are comsidered ‘owners’ of the mutual so are offered money or shares when demutualisation tajes place ( aka NRMA).

Me too

I reckon nzi. Was nzi colonial prudential sov now aia.

Me too

I held shares with National Mutual Holdings Limited and not sure what ever happened to them. How do I trace these? Many thanks.

Hi

Any advice on who to chase up about how much a relative had invested with Colonial Mutual? I need to find out how much was invested so I can do the maths on how many shares they had with CBA after the acquisition in 2000. Trying to sell these shares I’ve inherited and pay the Capitol Gains Tax. To do this though I need the amount AND purchase price of the shares between Colonial and CBA

Ed, in a previous comment, mentioned this, Colonial Mutual shareholders were provided with 7 CBA shares for each 20 Colonial Mutual shares that they held.

(This may be of interest to somebody in the future.)

I have recently needed to find the cost base for CBA shares (how much each CBA share was worth when they exchanged my Colonial Mutual shares for CBA shares in 2000). When CBA acquired Colonial Mutual, on 13 June 2000, each share was assigned a value of $26.39. Colonial Mutual shareholders were provided with 7 CBA shares for each 20 Colonial Mutual shares that they held.

Page 65 of the 2000 Annual Report:

http://www.commbank.com.au/about-us/shareholders/pdfs/annual-reports/2000_Annual_report_financial_statements_1MB.pdf

do you have a source document (eg company guidance / ATO ruling) for the Colonial demutualisation value of 3.31? I’m struggling to find one online these days

Sorry I don’t, I had the information back when I made the original post but that was some years ago.

Is there any chance you would know the price of AMP shares when it demutualise ? Thanks Bruce

The price of the shares at denationalisation was $10.43, since then there has been the Henderson demerger and 3 share capital returns. The cost base of the original shares at the moment is $6.19.

can you help me find shares that i believe i have with the old National Mutual Life Assoc. Unfortunetly I have not kept paper work as life has changed and Ive moved several times. So how and who do I contact to try get any information so that my curiosity is at ease.

Many thanks

Toni

From CGT Reporter:

Reconstruction – 1/07/96 – National Mutual Life Association corporatised into National Mutual Holdings (now Axa).

Public Offer – 8/10/96 – Listed on 8/10/96 as National Mutual Holdings Ltd after an IPO at $1.50 per share.

Formation – 8/10/96 – Policyholders got ‘free, demutualisation’ shares in NMH with an ATO advised CGT value of $1.14 ea.

Thank you for your information, as it is from the CGT reporter it would be accurate.

I think David is right. National Mutual/AXA shares’s cost base is $1.14 and the deemed acquisition date is 08/10/1996. Cheers.

Thanks David for your input, will look into it.

Geoff

I have just researched my cheque book back in 1996 and the cost of purchasing additional shares in National Mutual (later AXA) on 8 October 1996 was $1.50 each other than the free issued shares with a cost base of $1.17.

Cheers John.

Hi,

(This may be of interest to somebody in the future.)

I have recently needed to find the cost base for CBA shares (how much each CBA share was worth when they exchanged my Colonial Mutual shares for CBA shares in 2000). When CBA acquired Colonial Mutual, on 13 June 2000, each share was assigned a value of $26.39. Colonial Mutual shareholders were provided with 7 CBA shares for each 20 Colonial Mutual shares that they held.

Page 65 of the 2000 Annual Report:

http://www.commbank.com.au/about-us/shareholders/pdfs/annual-reports/2000_Annual_report_financial_statements_1MB.pdf

Regards

Thank you Ed, I am sure this will be helpful.

Thank you Ed!

Dear Sir,

What was the IPO price of National Mutual in 1996 that was taken over by AXA later.

I think it was either $1.60 or $1.80

regards

The AXA entry may not be correct. My shares were acquired October 3 and 4 1996, not November 7. Also other sites list the price as $1.14 but strangely have a date of August 1995. Rather perplexing for those of us dealing with the AMP buyout of AXA this year.

But thanks for the site.

Hi

Your figure for NRMA may be a bit misleading to readers as the cost base you have is for the optional additional shares which could be purchased at time of the allocation of original NRMA shares. The original shares distributed at demutalisation have a cost base of $1.78 and a date of issue of 19/6/2000.

Regards

Peter