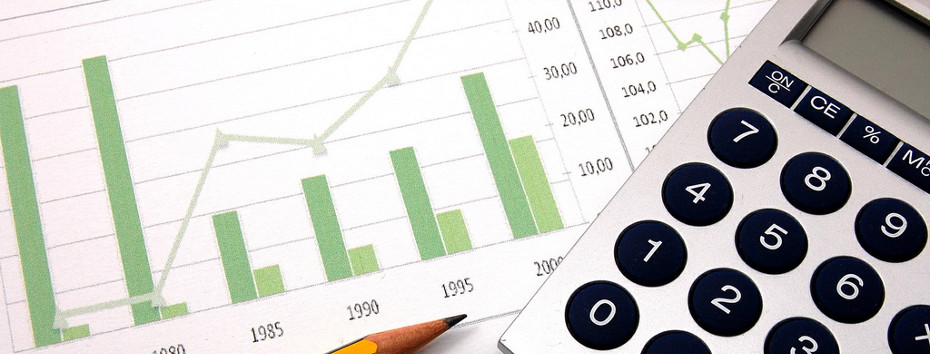

Simplify Your Accounting with QuickBooks Online: Introducing Our Hassle-Free Bookkeeping Service and Service Packages!

Introduction Established in June 1996, Highland Accounting Services is a trusted registered tax agent and accounting firm located in Adelaide’s northeastern suburb of Gilles Plains. With a team consisting of a full-time accountant and a part-time accountant, we are dedicated to providing excellent service to our clients. In today’s fast-pacedRead More →